Last Week in DeFi - PolyNetwork Exploit, CCTP Live on Arbitrum, Introducing ZK Stack, and More...

Recap: Week of Jun 26th

Product Launches 🚀

CCTP Live on Arbitrum

Circle’s native USDC bridging technology CCTP is now live on Arbitrum. Compared to traditional bridges with liquidity pools using a “lock and mint” mechanism, CCTP uses a burn and mint mechanism made possible because Circle is the issuer of USDC. This potentially increases security as there is no liquidity pool to be hacked.Multiple bridge providers including Celer, Multichain, Wormhole, and more announced support for CCTP.

Compound Founder Launches Bond Fund

Robert Leshner, the founder of Compound Finance, announced Superstate Funds, a fund that focuses on bringing regulated financial products like Government bonds, to blockchain.WBTC, ETH Markets for crvUSD Live

Curve launches the WBTC and ETH markets for crvUSD borrowing.Cosmos and Polkadot Bridge

Centauri Bridge launched, connecting Polkadot and Cosmos ecosystems.Super Stake SOL

Super Stake SOL just launched. This leveraged LSD project loops staked SOL, allowing users to earn an extra yield on their SOL.Nevermined on Ghosis Chain

Nevermined, a Data and AI marketplace, launched on Gnosis Chain.Diva Mainnet Launch

Diva launches mainnet and is now available on Ethereum, Polygon, Gnosis, and Arbitrum. Diva is an infrastructure protocol that enables custom derivative financial contracts peer-to-peer, allowing anyone to create and settle derivative assets.Ironfish Desktop Node App Live

Privacy chain Iron Fish just launched its Desktop Node app. Previously only available via CLI, the desktop node app allows anyone to easily run an Iron Fish Node which helps them secure the network and also use it to send and receive private transactions.Aptos NFT Aggregator

Aptos now has an NFT aggregator. Mercato NFT Marketplace just launched and features “Market aggregation, Portfolio PnL, and Lightning Fast Data”.

Project Updates 🚩

Introducing ZK Stack

Matter Labs released the ZK Stack for building ‘Hyperchains’. Devs who build Hyperchains can choose to create Layer 2s that run parallel to zkSync Era, or Layer 3s that run on top of it.Polygon 2.0: Restaking and Bridge

Polygon Labs has announced Polygon 2.0 architecture, including an interoperability layer, and Staking Layer which will use Polygon’s token via restaking.Central Banks Exploring Curve

Central banks of France, Singapore, and Switzerland are exploring the use of Curve’s v2 HFMM for the use of CBDCs.Neon EVM Closed Beta on Solana

Neon EVM launched a closed beta on the Solana mainnet, which is only accessible for whitelisted devs as of now. Neon also released an updated whitepaper, detailing how it will expand Ethereum dApps to Solana.Oasis.app Now Summer.fi

Oasis.app, the first lending product by MakerDAO and now a DeFi automation platform, rebrands to Summer.fi.Reserve Gets License

Reserve Protocol got a license from OFAC to operate in Venezuela through its Rpay stablecoin wallet.DeBridge on Solana

deBridge is now live on Solana, allowing for transfers between EVM and Solana blockchains.Sudoswap Wrapped Pools

Sudoswap founder and core dev 0xmons announced wrapped pools in his “sudoswap sundays” thread. Wrapped pools are Sudoswap NFT LP pools wrapped into their own NFT. This allows for composability, and also “Zorbs” - dynamically generated images for each Sudoswap pool NFT based on on-chain data.XRP Hedge Fund

Arrington Capital recently filed with the SEC for an XRP-based hedge fund.HSBC Enables BTC, ETH ETFs in Hong Kong

HSBC, the largest bank in Hong Kong, is now the first bank in HK to allow its customers to buy and sell BTC and ETH ETFs listed on the Hong Kong exchange.

Governance Highlights 📝

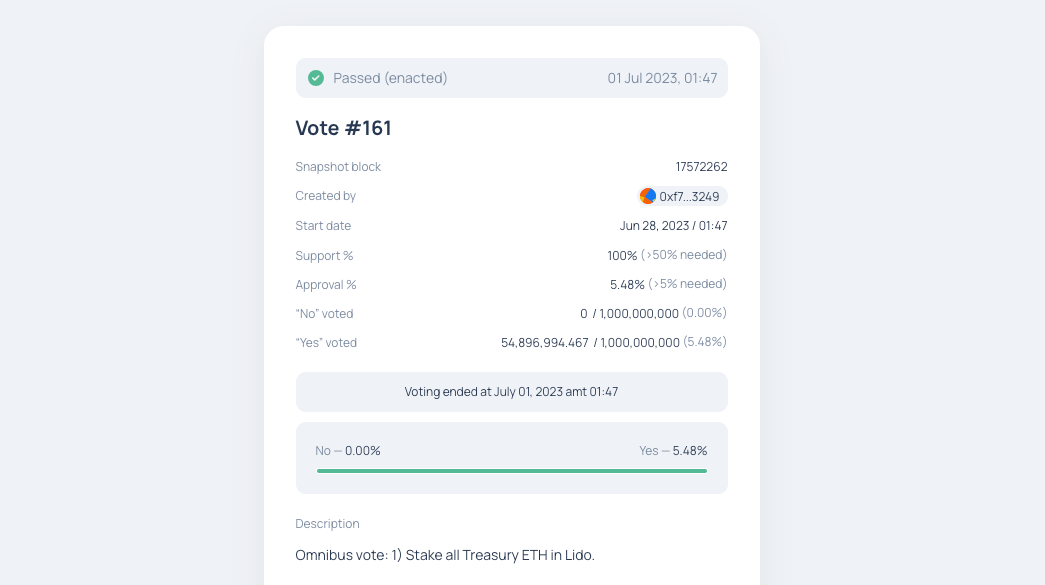

Lido Treasury Staking

Lido approved the vote and has staked all ETH in the treasury (20.3k) to stETH. Lido is now the 13th largest holder with 33k stETH holding.Silo to Support CVX Bribing

Silo community proposes to allocate 2M $SILO to provide incentives for vlCVX holders to vote for XAI-3CRV pool ( to be created) or/and XAI-FRAXBP Curve pool. The proposal aims to generate deeper liquidity for $XAI which in turn allows us to extend further credit lines to active markets.

Hacks/Issues 👾

PolyNetwork Exploit

Crosschain protocool PolyNetwork was hacekd and in loss of 34b. The attacker inserted malicious code and issued tokens from PolyNetwork's Ethereum pool to their own address on other chains, such as Metis, Polygon, and the BnB chain. The team has suspended services to investigate the issue.SMG Halts Ethereum

Special Mechanism Group "halted Ethereum transactions” for 12 seconds, by exploiting PBS (proposer builder separation). SMG achieved this by proposing an empty block and outbidding others for block inclusion. In their thread, SMG argues for a more censorship-resistant approach.Yield Protocol Restored

Yield Protocol, a victim of the Euler hack, has fully recovered funds and is back in operation.

Upcoming ⏳

Maple Lending Desk

Undercollateralized CeDeFi lending platform Maple Finance is launching a lending desk in July.Stader ETHx Mainnet Soon

LSD protocol Stader will launch ETHx on July 10th.EigenLayer to Increase Restaking Cap

Eigen Layer will increase its restaking capacity on Liquid Staking Tokens (LSTs) sometime during the week of July 10.

Today in DeFi Premium includes early looks at promising projects, yield farming tips, and proper research to help you get the most out of DeFi.

For example, last week we published the following features for our Premium Subscribers:

High APR Stable Farming

Incentivized Liquidity

Earn on Maker DSR

and more…

If you haven’t, subscribe today with Credit Card or Crypto (get discounts on quarterly or yearly subscriptions).