Last Week in DeFi - Worldcoin Live, Chainlink CCIP, Mantle L2 Mainnet, and More...

Recap: Week of July 17th

Product Launches 🚀

Worldcoin Live

UBI project Worldcoin officially launches with the WLD token. Users can download the World App and get a World ID by getting verified by an Orb.Mantle Mainnet Live

Built by BitDAO, Mantle L2 mainnet alpha is now live, as well as the BIT-MNT conversion tool. Mantle also launches a grants program and an EcoFund to support developments. The next step for Mantle is to build mntETH - Mantle's LSD product.UniswapX Live

Uniswap launches UniswapX, a DEX aggregator that provides better prices, gas-free swapping, MEV protection, and does not charge on failed tx.Chainlink CCIP Live

Chainlink launches Cross-Chain Interoperability Protocol (CCIP) on Avalanche, Ethereum, Optimism, and Polygon. CCIP is an interoperability protocol for building cross-chain applications and services.Neon EVM Live on Solana

Neon EVM launches mainnet on Solana, enabling devs to build EVM dApps on top of Solana. The NEON token is also listed and trading on Coinlist.GHO Liquidity Pools

The first three GHO LP pools went live on Balancer, including $GHO / bb-a-USD, $wstETH / $GHO (80/20), and $GHO / $LUSD.PSY Live on Arbitrum

LSDfi protocol PSY went live on Arbitrum, allowing users to borrow 0% interest stablecoin against their LSD tokens.Y2K GTRADE Vaults

Y2K finance launches the Gains Trader PnL Protection Vaults, an insurance program that protects gDAI holders from potential losses resulting from profit wins on gains.network.GNS gETH Live

Arbitrum-based yield protocol GND protocol launches gETH. Users can mint gETH with $wstETH, $sfrxETH, $rETH, $WETH, $ETH, or $gmdETH, and farm gETH LP farm for good yield.Rysk DHV Live on Arbitrum

Options protocol Rysk launches the ETH/USDC Dynamic Hedging Vault (DHV) on Arbitrum. DHV allows LPs to generate returns on USDC by market-making ETH options trades.Stakewise V3 Testnet

Stakewise launches public testnet for V3. V3 has a marketplace for staking pools called Vaults. Users get to choose their preferred Vualts to earn ETH staking rewards while keeping the liquidity of their stakes with osETH.

Project Updates 🚩

Polkadot 1.0 Realized

Polkadot released the complete version of its 1.0. The Polkadot codebase is now functionally complete and has been handed over to the community with the launch of Polkadot OpenGov and the migration of all runtime code to a repository managed by the Technical Fellowship.DeFi Saver Supports crvUSD

DeFi automation platform Defi Saver now supports crvUSD with a dedicated dashboard and DFS features including creating instantly leveraged positions, repay & boost, and self-liquidating with collateral.Worldcoin Migrates to OP Mainent

UBI project Worldcoin has completed migration to the OP mainnet and has begun migrating World ID and World App users.Axelar Interchain Token Service

Axelar introduces Interchain Token Service (ITS), supporting Interchain Tokens that preserve cross-chain fungibility and custom functionality. ITS allows teams to easily manage supply and features through the creation of Interchain Tokens.Osmosis Supercharged Liquidity

Osmosis DEX now supports Supercharged Liquidity, allowing users to concentrate liquidity around the current spot price to increase capital efficiency and capture more fees.Pendle Earn

Pendle relaunches Discounted Assets as Pendle Earn. Pendle Earn earns fixed yields on major assets including stablecoins and LSTs, lowering the barrier to access DeFi yields.Stargate Fantom Pool Live

Stargate launches the USDC pool on Fantom with STG liquidity rewards live. Stargate now supports transfers between Fantom, Ethereum, BNB Chain, Avalanche, Polygon, Arbitrum, and Optimism.Stride Adopts Interchain Security

Stride, a cosmos-based liquid staking chain, has adopted Interchain Security (ICS). The transition indicates that Stride’s blockchain pivots from using staked STRD for its economic security to relying on staked ATOM.Starknet Appchains

Starknet introduces Appchains in EthCC, and will launch the first Starknet appchain closed beta soon. Devs will be able to build their own appchains (Ethereum L2s) using Starknet Stack.Ankr zkSync Enterprise Solutions

Ankr and Matter Labs partner up to launch dedicated zkSync Era Nodes and Hyperchain blockchain solutions on the Microsoft Azure Marketplace. Enterprises can build dApps on top of zkSync Era, or build their own chains.USDC Bank Transfers

Utopia Labs has enabled USDC bank transfers for businesses. KYC'd businesses in the US are able to off-ramp USDC to banks without going through a centralized exchange.

Governance Highlights 📝

Proposal: Enhanced DSR

MakerDAO community proposes the Enhanced DAI Savings Rate (EDSR), a system to temporarily increase DSR available to users in the early bootstrapping stage when the DSR utilization is low.Proposal: Buyback-and-Make T

Threshold community proposes a buyback-and-make model to link tBTC growth with the protocol token T. The model will use all tBTC fees to buy into an 80/20 T/tBTC pool. The proposal also suggests updating the tBTC V2 fee program to optimize growth.

Hacks/Issues 👾

Conic Hacks

Yield protocol Conic was hacked twice and lost 3.2m and 934k on its ETH and crvUSD pools respectively. The root cause for the ETH pool attack was a reentrancy attack, while the cause for the crvUSD pool was a sandwich attack. Conic team has temporarily shutdown all omnipools and is trying to contact the hackersHector to Liquidate 16M Treasury

Fantom-based DEX Hector Network voted to liquidate its $16m treasury following Multichain, Fantom losses.Geist Shutting Down

Fantom-based lending protocol Geist is shutting down due to the Multichain exploits.Rodeo Remediation Plan

A week after the ~880k hack, Arbitrum-based yield protocol Rodeo published a recovery plan that will allow LPs to withdraw what they originally deposited in the protocol.

Upcoming ⏳

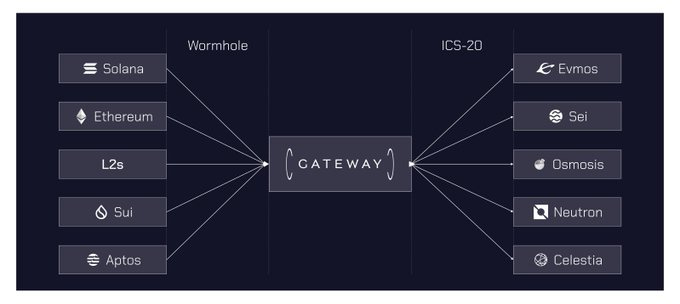

Wormhole Gateway

Wormhole introduces Gateway, a Cosmos-SDK-powered chain that will connect 23+ Wormhole-supported blockchains to Cosmos via IBC integration. Users will be able to bridge assets to and from Cosmos, and devs will be able to integrate their dApps with Gateway.

Today in DeFi Premium includes early looks at promising projects, yield farming tips, and proper research to help you get the most out of DeFi.

For example, last week we published the following features for our Premium Subscribers:

Fixed-rate Lending

Lend to Earn

Yield Trading

and more…

If you haven’t, subscribe today with Credit Card or Crypto (get discounts on quarterly or yearly subscriptions).